Introduction

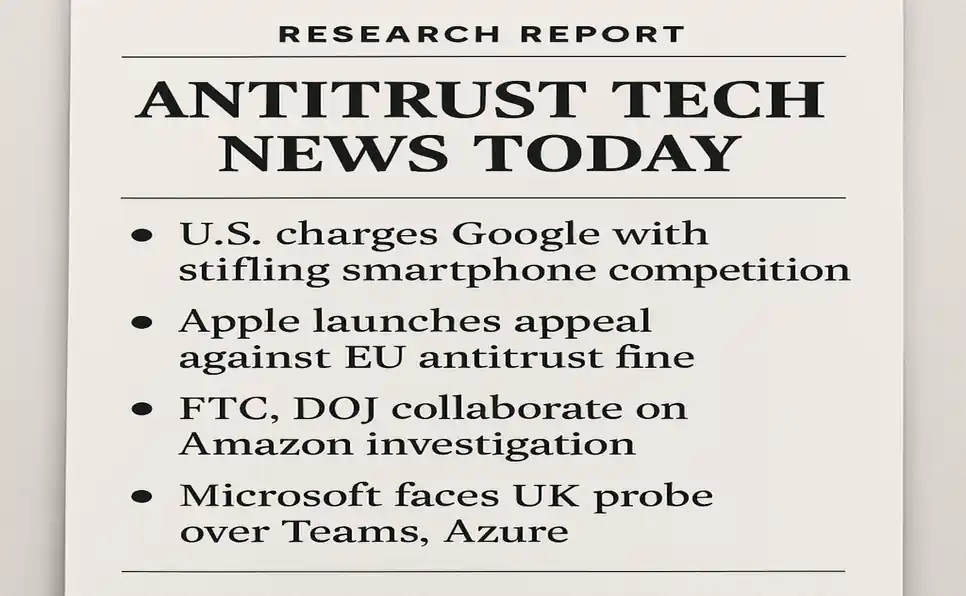

The technology sector stands at the epicenter of a new era in antitrust enforcement. As of January 2026, governments and regulators worldwide are intensifying scrutiny of major technology companies, including Google, Apple, Amazon, Meta, Microsoft, Nvidia, and others, through a combination of litigation, regulatory investigations, and sweeping new laws. This report offers a comprehensive and in-depth analysis of the most recent and significant antitrust developments impacting the global technology industry, drawing insights commonly highlighted in antitrust tech news today. It covers the latest legal actions, regulatory frameworks, and industry responses, with a focus on the United States, European Union, India, China, and other key jurisdictions. The analysis draws on a wide range of authoritative sources and addresses the implications for competition, innovation, and the future of artificial intelligence (AI).

Global Overview: The Evolving Antitrust Landscape in Tech

The New Era of Antitrust Tech News Today

The past two years have seen a marked escalation in antitrust enforcement against technology giants. This trend is driven by concerns over market concentration, the gatekeeping power of digital platforms, and the potential for dominant firms to stifle innovation and competition, especially in emerging fields like AI and cloud computing. The United States, European Union, and several national authorities have launched high-profile lawsuits and investigations, while new regulatory regimes such as the EU’s Digital Markets Act (DMA) and the UK’s Digital Markets, Competition and Consumers Act (DMCC Act) have come into force.

A defining feature of the current landscape is the convergence of traditional antitrust enforcement with new ex-ante regulatory obligations. The DMA, for example, imposes proactive requirements on designated “gatekeepers” to ensure fair competition, while the US continues to rely on litigation under the Sherman and Clayton Acts. Meanwhile, cross-border coordination among regulators is increasing, with the EU and Japan formalizing cooperation on digital market regulation and other jurisdictions aligning their approaches.

Political and Economic Context

The regulatory environment is shaped by shifting political priorities. The second Trump administration in the US has signaled a more selective approach to antitrust, prioritizing AI leadership and economic growth, but has not rolled back ongoing major cases against Big Tech. In Europe, enforcement is intensifying, with record fines and a commitment to sustained action against non-compliant platforms. The resulting transatlantic tensions have raised the specter of retaliatory tariffs and a potential trade conflict over digital regulation.

Google (Alphabet): Search, Advertising, and AI Under Fire

US Search Monopoly Case and Appeal

In August 2024, a landmark ruling by US District Judge Amit Mehta found that Google had illegally maintained a monopoly in the general search and search advertising markets, primarily through exclusive default agreements with device manufacturers and browsers. The court concluded that Google’s dominance, controlling over 89% of the search market was reinforced by billions in annual payments to partners, creating a self-reinforcing cycle that blocked competitors and stifled innovation.

The remedies phase concluded in December 2025. Judge Mehta rejected the Department of Justice’s (DOJ) most severe proposals, such as a forced divestiture of Chrome, but ordered Google to share certain raw search interaction data with qualified competitors and to limit the duration of future exclusive agreements. Google immediately filed an appeal in January 2026, seeking to pause the implementation of these remedies, arguing that they would risk user privacy and discourage innovation. The appeal is expected to delay any structural changes for months or years, though the company has indicated willingness to comply with less intrusive requirements in the interim.

Key Legal Dates and Status:

- August 2024: Liability ruling against Google in US search monopoly case

- December 2025: Remedies finalized; Google ordered to share search data, but not algorithms

- January 16, 2026: Google files an appeal and seeks to pause remedies

Implications:

The case is a watershed for US antitrust enforcement, setting a precedent for future actions against digital platforms. While the remedies are less severe than some had anticipated, the requirement to share search data could lower barriers for rivals and reshape the competitive landscape. However, the delay caused by the appeal means that the full impact remains uncertain.

EU and International Investigations: Advertising and AI

EU Adtech Fine and Ongoing Probes

In September 2025, the European Commission fined Google €2.95 billion for abusing its dominant position in the online advertising technology (adtech) sector. The Commission found that Google had favored its own ad exchange (AdX) in the ad selection process and imposed self-preferencing practices that harmed competing adtech providers, advertisers, and publishers. Google was ordered to end these practices and address inherent conflicts of interest in its adtech supply chain. The Commission signaled that only a structural remedy, potentially a divestiture, might fully resolve the issue, though Google has been given an opportunity to propose alternatives.

Key Legal Dates and Status:

- September 5, 2025: EU fines Google €2.95 billion for adtech abuses; Google has 60 days to propose remedies

- December 2025: EU opens formal investigation into Google’s use of online content for AI training, focusing on whether Google unfairly uses publishers’ and YouTube creators’ content without compensation or opt-out options

AI and Content Scraping

The European Commission’s December 2025 probe targets Google’s use of web and video content to train generative AI models (e.g., AI Overviews, AI Mode), raising questions about competition, copyright, and the rights of content creators. The investigation will assess whether Google’s practices distort competition by imposing unfair terms on publishers and by granting itself privileged access to data, potentially disadvantaging rival AI developers.

International Developments:

- Japan and India have also launched investigations into Google’s practices, including requirements for pre-installation of Google apps on Android devices and alleged abuses in the smart TV market.

- The UK’s Competition and Markets Authority (CMA) and other national authorities are scrutinizing Google’s dominance in search and adtech, with parallel class-action lawsuits underway.

Implications:

Google faces a multi-front regulatory battle in the US, EU, and beyond. The adtech fine and AI content probe reflect a broader shift toward regulating the data and infrastructure underpinning digital markets. The outcome will influence not only Google’s business model but also the future of AI development and competition in digital advertising.

Apple: Global Antitrust Pressure and Legal Showdowns

India: CCI Antitrust Case and Penalty Rules Dispute

Apple is embroiled in a high-stakes antitrust case before India’s Competition Commission (CCI), which has accused the company of abusing its dominant position in the iOS app ecosystem. The case centers on Apple’s requirement that app developers use its in-app purchase system, restrictions on alternative payment methods, and selective enforcement of billing options. Following a detailed investigation, the CCI’s probe concluded in 2024 that Apple had violated competition norms.

Apple has sought to delay the proceedings by challenging the CCI’s penalty framework, specifically, the use of global turnover as the basis for fines, which could expose the company to penalties of up to $38 billion. The Delhi High Court is currently hearing Apple’s challenge, but the CCI has refused to pause its enforcement, issuing a final warning in December 2025 that it will proceed unilaterally if Apple does not respond.

Key Legal Dates and Status:

- December 31, 2025: CCI issues final warning to Apple; threatens to proceed without the company’s input

- January 27, 2026: Next scheduled hearing in the Delhi High Court on penalty rules

Implications:

The case is a test of India’s resolve to enforce antitrust laws against global tech giants. The CCI’s willingness to move forward despite parallel court challenges could set a precedent for future investigations. For Apple, the risk of a massive fine and potential changes to its App Store policies in India is significant.

United States: DOJ Lawsuit and App Store Litigation

The US Department of Justice (DOJ), joined by 16 states and the District of Columbia, filed a major antitrust lawsuit against Apple in March 2024, alleging that the company maintains an illegal monopoly in the smartphone and high-end performance smartphone markets. The suit claims Apple blocks innovative apps and services, degrades cross-platform messaging, limits third-party device compatibility, and suppresses cloud gaming and digital wallets, all to lock users into its ecosystem.

In June 2025, the US District Court for the District of New Jersey denied Apple’s motion to dismiss, allowing the case to proceed to trial. The court found that the DOJ had plausibly alleged monopoly power (65–70% market share) and exclusionary conduct. Apple’s arguments that its restrictions were reasonable and justified by security and user experience concerns were deemed factual disputes for trial.

Key Legal Dates and Status:

- March 2024: DOJ and states file antitrust suit against Apple

- June 30, 2025: Court denies Apple’s motion to dismiss; case proceeds to discovery and trial

- Ongoing: Apple faces additional state and class-action litigation over App Store practices and payment restrictions

Recent Penalties and Global Actions:

- April 2025: EU fines Apple €500 million for DMA non-compliance (anti-steering in App Store)

- January 2026: Italy fines Apple $116 million over App Tracking Transparency policy, alleging privacy features are used as competitive weapons

- New Jersey: Apple fined $150,000 for violating a decade-old agreement; faces potential criminal contempt for non-compliance with App Store reforms

Implications:

Apple is under coordinated regulatory assault across multiple jurisdictions. The US DOJ case, if successful, could force Apple to open its platform to greater interoperability and alternative payment systems. The EU and India’s actions further threaten Apple’s control over its ecosystem and revenue streams. The company’s traditional defense, emphasizing innovation and user experience, is facing increasing skepticism from regulators who view its practices as systematic market manipulation.

Amazon: Marketplace Power, Price-Gouging, and Litigation

US Marketplace Antitrust and Price-Gouging Litigation

Amazon faces mounting legal challenges over its marketplace practices. In September 2024, a federal judge allowed the Federal Trade Commission’s (FTC) antitrust lawsuit to proceed, targeting Amazon’s alleged illegal monopoly in online retail and marketplace services. The FTC claims Amazon punishes sellers who offer lower prices elsewhere, pressures them to use its fulfillment services, and manipulates search results to favor its own products. The case is scheduled for trial in February 2027.

Separately, Amazon is defending a class-action lawsuit over alleged price-gouging during the COVID-19 pandemic. In January 2026, US District Judge Richard Jones ruled that Amazon must face claims that it systematically inflated prices on essential goods, both through its own retail division and by failing to prevent third-party sellers from gouging consumers. The court found that Amazon’s algorithmic pricing models and control over transactions could make it directly liable under state consumer protection laws.

Key Legal Dates and Status:

- September 2024: FTC antitrust case against Amazon survives motion to dismiss; trial set for February 2027

- January 5, 2026: Judge allows price-gouging class action to proceed; discovery phase to probe Amazon’s pricing algorithms

Implications:

The price-gouging litigation is a bellwether for algorithmic accountability in digital marketplaces. If Amazon is found liable, it could face massive financial penalties, mandatory algorithmic audits, and increased insurance costs. The FTC case, meanwhile, could force changes to Amazon’s marketplace policies, fulfillment requirements, and search practices. Both cases highlight the growing willingness of courts and regulators to hold platforms accountable for systemic pricing and competition issues.

Meta (Facebook): AI Interoperability, Data Silos, and Global Orders

WhatsApp AI Interoperability Orders and EU/India Rulings

Meta’s ambitions to integrate its proprietary “Meta AI” assistant into WhatsApp have run into a global regulatory wall. In December 2025, Italy’s antitrust authority (AGCM) issued an interim order forcing Meta to suspend terms that excluded third-party AI competitors from WhatsApp, citing abuse of dominance and potential harm to competition and consumers. The order requires Meta to allow rival AI chatbots to operate on the platform while the investigation continues.

The European Commission opened a parallel investigation in December 2025, focusing on whether Meta’s updated WhatsApp Business terms breach competition rules by foreclosing access to the platform for AI competitors like OpenAI and Anthropic. Regulators are concerned that Meta’s nearly 3 billion WhatsApp users could be leveraged to entrench Meta AI and stifle nascent AI startups.

In India, the National Company Law Appellate Tribunal (NCLAT) upheld a significant fine and a five-year ban on Meta sharing WhatsApp user data with its other platforms, effectively creating a “data silo” that limits Meta’s ability to build comprehensive user profiles for advertising.

Key Legal Dates and Status:

- December 24, 2025: Italy orders Meta to suspend exclusionary WhatsApp terms

- December 4, 2025: EU opens formal investigation into WhatsApp AI interoperability

- Late 2025: India upholds fine and data-sharing ban on Meta

Implications:

These orders mark a shift from privacy-focused regulation to proactive enforcement of “AI interoperability.” Meta is now required to allow competing AI assistants on WhatsApp and to maintain strict data silos in key markets. The rulings set a precedent that platform owners cannot grant their own AI services special privileges, with potential ripple effects for Apple, Google, and others integrating AI into core products.

US and EU Antitrust Litigation

Meta continues to face antitrust litigation in the US and EU over its acquisitions of Instagram and WhatsApp, as well as its advertising and data practices. In the US, the FTC’s case survived summary judgment and went to trial in April 2025, focusing on whether Meta’s acquisitions were designed to neutralize competition. The EU fined Meta €200 million in April 2025 for DMA non-compliance related to its “pay or consent” advertising model.

Implications:

Meta’s regulatory challenges are forcing it to redesign its platforms for greater interoperability and user choice. While Wall Street remains optimistic about Meta’s AI-driven growth, the company’s ability to navigate these requirements without compromising user experience or innovation is under close scrutiny.

Microsoft: AI Partnerships, Cloud Dominance, and Regulatory Scrutiny

FTC Investigation: AI, Bundling, and National Security

The US Federal Trade Commission (FTC) has launched its most comprehensive investigation into Microsoft since the 1990s, targeting the company’s dominance in cloud computing, bundling of productivity and security software, and multi-billion-dollar partnership with OpenAI. The probe, initiated in late 2024 and continuing under the Trump administration, seeks detailed information on Microsoft’s AI operations, data centers, licensing practices, and the structure of its relationship with OpenAI.

Key concerns include:

- Whether Microsoft’s bundling of Office with cloud and security services unfairly excludes competitors, especially in government contracts

- Whether the OpenAI partnership amounts to an undisclosed merger, giving Microsoft exclusive access to critical AI technology

- The impact of major cybersecurity breaches on national security, given the government’s reliance on Microsoft products

Key Legal Dates and Status:

- November 2024: FTC issues civil investigative demand; investigation ongoing through 2025 and into 2026

- September 2025: Senator Ron Wyden calls for an investigation into Microsoft’s cybersecurity practices

Implications:

The investigation could lead to significant changes in Microsoft’s licensing, bundling, and AI partnership practices. It also raises broader questions about market concentration in critical infrastructure and the intersection of antitrust and national security. The outcome will influence not only Microsoft but also the structure of the broader tech ecosystem.

EU and UK Investigations

The European Commission has issued a Statement of Objections regarding Microsoft’s bundling of Teams with Office 365, alleging that the practice deprives customers of real choice and could foreclose competing communication tools. The UK’s CMA is also investigating Microsoft’s cloud licensing and AI partnerships, with a focus on whether recent “acqui-hire” deals and minority investments in AI startups constitute notifiable mergers.

Implications:

Microsoft’s strategy of integrating AI and cloud services is under increasing regulatory scrutiny. The company’s ability to demonstrate that its practices promote innovation and do not foreclose competition will be critical to avoiding structural remedies or forced divestitures.

Other Major Tech Companies: Nvidia, OpenAI, ByteDance, TikTok

NVIDIA: Global Antitrust Probes

NVIDIA, the dominant supplier of AI chips, is under investigation by multiple jurisdictions. In August 2024, the US DOJ launched an antitrust probe into Nvidia’s sales practices, focusing on allegations of exclusive dealing, tying, and pressure on customers not to use competitors’ products. The investigation escalated in September 2024 with subpoenas and parallel inquiries in the EU, UK, South Korea, and China.

In September 2025, China’s State Administration for Market Regulation announced that Nvidia had violated the country’s antitrust law, specifically referencing its 2020 acquisition of Mellanox Technologies. While no penalties have been announced, China has vowed further investigation, and the case is seen as part of broader US-China tensions over semiconductor supremacy.

Implications:

NVIDIA’s early-mover advantage in AI chips is now a regulatory target. The outcome of these probes will shape competition in the AI hardware stack and could influence global supply chains.

OpenAI: Partnership Scrutiny and Copyright Litigation

OpenAI’s partnerships with Microsoft and other tech giants are under review by the FTC, CMA, and other regulators, who are concerned about “pseudo-mergers” that bypass traditional antitrust review. Meanwhile, OpenAI faces a wave of copyright lawsuits over the use of online content to train its models, with courts beginning to address whether such training constitutes fair use.

Implications:

The regulatory and legal challenges facing OpenAI will determine the boundaries of AI partnerships, data use, and competition in the generative AI sector.

ByteDance and TikTok: US and EU Actions

ByteDance, the parent company of TikTok, faces ongoing scrutiny in the US and EU. The US has imposed deadlines for ByteDance to divest TikTok or face a ban, citing national security and competition concerns. The EU has designated ByteDance as a “gatekeeper” under the DMA, subjecting it to interoperability and data-sharing requirements.

Implications:

The future of TikTok in Western markets remains uncertain, with regulatory actions driven by a mix of antitrust, data privacy, and geopolitical considerations.

Regulatory Frameworks and New Laws

The Digital Markets Act (DMA) and Global DMA-Like Proposals

The EU’s DMA, fully applicable since May 2023, imposes strict obligations on designated gatekeepers Alphabet, Amazon, Apple, ByteDance, Meta, and Microsoft to prevent self-preferencing, require interoperability, and limit data combination across services. The DMA is enforced alongside traditional ex-post antitrust actions, with the European Commission opening multiple non-compliance investigations and imposing record fines in 2025.

The UK’s DMCC Act, effective January 2025, allows the CMA to craft bespoke conduct requirements for firms with strategic market status, offering a more flexible approach than the DMA. Japan and the EU have formalized cooperation on digital market regulation, and other jurisdictions, including India, South Korea, and Australia are adopting similar frameworks.

Key Legal Dates and Status:

- May 2023: DMA becomes fully applicable in the EU

- April 2025: Apple and Meta fined for DMA non-compliance

- December 2025: EU opens new investigations into Google, Meta, and others

- August 2026: EU AI Act becomes fully enforceable, imposing new obligations on high-risk AI systems

Implications:

The DMA and similar laws are reshaping the compliance landscape for global tech companies. The requirements for interoperability, data access, and non-discrimination are forcing platforms to redesign products and business models, with significant operational and financial implications.

US Antitrust Enforcement: DOJ, FTC, and State AGs

The US continues to rely on litigation under the Sherman and Clayton Acts, with the DOJ and FTC pursuing major cases against Google, Apple, Amazon, Meta, and Microsoft. State attorneys general have become increasingly active, often running parallel investigations and lawsuits, especially in areas like algorithmic price-fixing, labor markets, and consumer protection.

The new leadership at the FTC and DOJ under the Trump administration has signaled a more selective, evidence-based approach, focusing on cases with higher success probability and emphasizing business certainty and innovation. However, ongoing cases initiated under previous administrations continue to move forward.

Implications:

The US approach remains litigation-driven, with structural remedies and divestitures on the table in the most egregious cases. The interplay between federal and state enforcement adds complexity and risk for tech companies.

Comparative Table: Major Antitrust Actions by Company and Jurisdiction

| Company | US Actions (DOJ/FTC/States) | EU Actions (EC/DMA) | India (CCI/NCLAT) | China (SAMR) | Other Notable Actions |

| Search monopoly case (appeal pending); Adtech monopoly case (remedies trial); Class actions (search, app store) | €2.95B adtech fine; DMA non-compliance probe; AI content probe | Android, smart TV investigations | N/A | UK, Japan, Australia probes; UK class action | |

| Apple | DOJ smartphone monopoly suit (trial pending); App Store litigation; State AG actions | €500M DMA fine; App Tracking Transparency fine (Italy); DMA non-compliance probe | CCI antitrust case; Penalty rules dispute | N/A | South Korea, Australia app store cases |

| Amazon | FTC marketplace monopoly suit (trial 2027); Price-gouging class action | DMA gatekeeper; Search ranking changes; Ongoing probes | N/A | N/A | EU, UK, and state AG investigations |

| Meta | FTC suit over Instagram/WhatsApp (trial 2025); Data practices scrutiny | €200M DMA fine; WhatsApp AI interoperability probe; Data-sharing restrictions | NCLAT fine; Data silo order | N/A | Italy AGCM interim order; Brazil, India data cases |

| Microsoft | FTC investigation (AI, bundling, cloud); Teams bundling probe | Teams-Office bundling SO; DMA gatekeeper; Cloud licensing probe | N/A | N/A | UK CMA AI partnership reviews |

| Nvidia | DOJ AI chip market probe; Merger review | EU, UK, South Korea, China probes | N/A | Mellanox acquisition under investigation | N/A |

| OpenAI | FTC, CMA partnership scrutiny; Copyright litigation | N/A | N/A | N/A | US, EU, and global copyright lawsuits |

| ByteDance | TikTok divestiture deadline; National security review | DMA gatekeeper; Data-sharing, interoperability | N/A | N/A | US, EU, and India regulatory actions |

Table Analysis:

This table highlights the breadth and diversity of antitrust actions facing major tech companies. Google and Apple are under the most intense scrutiny globally, with overlapping cases in the US, EU, and India. Amazon and Meta face significant litigation over marketplace and data practices, while Microsoft’s AI and cloud dominance is a growing concern. NVIDIA and OpenAI represent the next frontier, as regulators turn their attention to the AI technology stack.

Industry Responses and Corporate Strategies

Compliance, Litigation, and Product Changes

Tech companies have responded to antitrust pressure with a mix of legal challenges, compliance adaptations, and strategic pivots. Common strategies include:

- Appealing adverse rulings and seeking to delay remedies (e.g., Google’s appeal in the search case; Apple’s challenge to penalty rules in India)

- Proactive product and policy changes to align with new regulations (e.g., Apple allowing alternative app stores in the EU; Meta offering less personalized ads in Europe; Amazon adjusting search rankings)

- Redesigning platforms for interoperability and user choice (e.g., Meta’s “consent-first” AI architecture for WhatsApp; Microsoft diversifying AI partnerships)

- Enhanced transparency and reporting (e.g., Amazon’s quarterly transparency reports; Google’s compliance updates)

- Legal and public relations campaigns emphasizing innovation, user benefits, and privacy concerns

Investor and Market Implications

Despite regulatory headwinds, most major tech stocks have remained resilient, with analysts viewing the current wave of enforcement as a “manageable operational drag” rather than an existential threat—at least for now. However, the risk of massive fines, forced divestitures, and operational changes remains material, especially as enforcement accelerates in the EU and other jurisdictions.

Implications for Competition, Innovation, and AI Development

Competition and Market Structure

The cumulative effect of these antitrust actions is to lower barriers to entry, promote interoperability, and prevent dominant platforms from leveraging their power across markets. The focus on AI interoperability, data access, and algorithmic transparency is designed to ensure that the next wave of digital innovation is not foreclosed by incumbent gatekeepers.

Innovation and Ecosystem Effects

There is an ongoing debate about whether aggressive antitrust enforcement will spur or stifle innovation. Proponents argue that breaking up monopolies and opening platforms will create a more dynamic ecosystem, enabling startups and new entrants to compete on the merits. Critics warn that excessive regulation could chill investment and slow the pace of technological progress, especially in fast-moving fields like AI.

AI and Data Governance

The intersection of antitrust and AI is a new frontier. Regulators are increasingly concerned about concentration in the AI technology stack chips, data, cloud infrastructure, and foundational models, and the risk that a handful of firms could control the future of artificial intelligence. The EU AI Act and similar laws are imposing new compliance obligations, while courts are beginning to address the legal status of AI training data and autonomous agents.

Enforcement Agencies and Key Officials

- US Department of Justice (DOJ) Antitrust Division: Led by Assistant Attorney General Gail Slater (as of early 2026), focusing on evidence-based, targeted enforcement with openness to settlements in complex cases.

- Federal Trade Commission (FTC): Chaired by Andrew Ferguson, emphasizing business certainty, continued scrutiny of Big Tech, and a case-by-case approach to labor market and algorithmic issues.

- European Commission (EC): Competition Commissioner Teresa Ribera, leading aggressive enforcement of the DMA and antitrust rules, with a focus on innovation and market contestability.

- UK Competition and Markets Authority (CMA): Enforcing the DMCC Act and reviewing AI partnerships and cloud licensing.

- India Competition Commission (CCI) and NCLAT: Pursuing landmark cases against Apple and Meta.

- China State Administration for Market Regulation (SAMR): Investigating Nvidia and other tech firms for antitrust violations.

- Italy AGCM, France, Germany, Japan JFTC: Active in national enforcement and cross-border coordination.

Litigation and Procedural Posture

- Appeals and Remedies Trials: Many major cases are in the remedies or appellate phase, with implementation of structural changes delayed by ongoing litigation (e.g., Google search and adtech cases, Apple DOJ suit).

- Class Actions and State Litigation: Parallel class actions and state AG lawsuits are increasingly common, especially in areas like price-gouging, algorithmic collusion, and consumer protection.

- Cross-Border Coordination: Regulators are sharing best practices, aligning enforcement strategies, and, in some cases, conducting joint investigations (e.g., EU-Japan cooperation on digital markets).

Cross-Border Coordination and Enforcement Trends

The trend toward cross-border regulatory cooperation is accelerating. The EU and Japan have formalized collaboration on digital market regulation, sharing best practices and investigatory tools. The UK, US, and other jurisdictions are increasingly referencing each other’s enforcement actions and adapting their approaches accordingly. This coordination raises the compliance burden for global tech companies but also offers the potential for more consistent and predictable regulation.

Practical Guidance for Stakeholders

For Investors

- Monitor ongoing litigation and regulatory developments, especially in the US, EU, and key emerging markets.

- Assess the potential financial impact of fines, divestitures, and operational changes on portfolio companies.

- Consider the implications of new regulatory frameworks (DMA, DMCC Act, AI Act) for business models and revenue streams.

For Startups and Competitors

- Leverage new interoperability and data access requirements to enter markets previously foreclosed by dominant platforms.

- Engage with regulators and participate in consultations on digital market regulation.

- Monitor opportunities created by structural remedies, divestitures, or mandated access to key infrastructure.

For Legal and Compliance Teams

- Conduct comprehensive risk assessments of business practices in light of evolving antitrust and digital market regulations.

- Prepare for increased reporting, transparency, and audit requirements, especially regarding algorithms, data use, and AI partnerships.

- Develop strategies for engaging with multiple regulators across jurisdictions, anticipating cross-border investigations and enforcement.

Conclusion

As of January 2026, the global technology sector is navigating an unprecedented wave of antitrust enforcement, regulatory innovation, and legal uncertainty. Major tech companies face overlapping lawsuits, investigations, and compliance obligations in the US, EU, India, China, and beyond. The focus has shifted from traditional market power to the infrastructure and data underpinning digital and AI markets. While the ultimate impact on competition and innovation remains to be seen, the direction of travel is clear: the era of unchecked platform dominance is ending, and a new, more contested digital landscape is emerging.

The coming year will be pivotal. The outcomes of pending appeals, remedies trials, and regulatory reviews will set the rules of the road for the next decade of technology and AI development. Stakeholders across the ecosystem investors, startups, legal teams, and policymakers must stay vigilant, adaptive, and engaged as the contours of the digital economy are redrawn.